H&R Block, Inc (NYSE:HRB) reported mixed fourth-quarter financial results and issued FY26 adjusted EPS results below estimates on Tuesday.

H&R Block reported quarterly earnings of $2.27 per share which missed the analyst consensus estimate of $2.83 per share. The company reported quarterly sales of $1.111 billion which beat the analyst consensus estimate of $1.075 billion.

H&R Block said it sees FY2026 adjusted EPS of $4.85-$5.00 per share, versus market estimates of $5.25. The company expects revenue of $3.875 billion to $3.895 billion, versus projections of $3.725 billion.

“Fiscal 2025 marked another year of meaningful progress in our transformation journey, with strong revenue growth, disciplined capital allocation, and continued innovation across our client offerings,” said Jeff Jones, president and chief executive officer. “As we look ahead, we are intensifying efforts to engage clients with more complex needs, expanding our small business reach, and further leveraging technology and AI to deliver greater business efficiencies and seamless, personalized experiences that distinguish H&R Block in the marketplace.”

H&R Block shares fell 4.8% to trade at $49.03 on Wednesday.

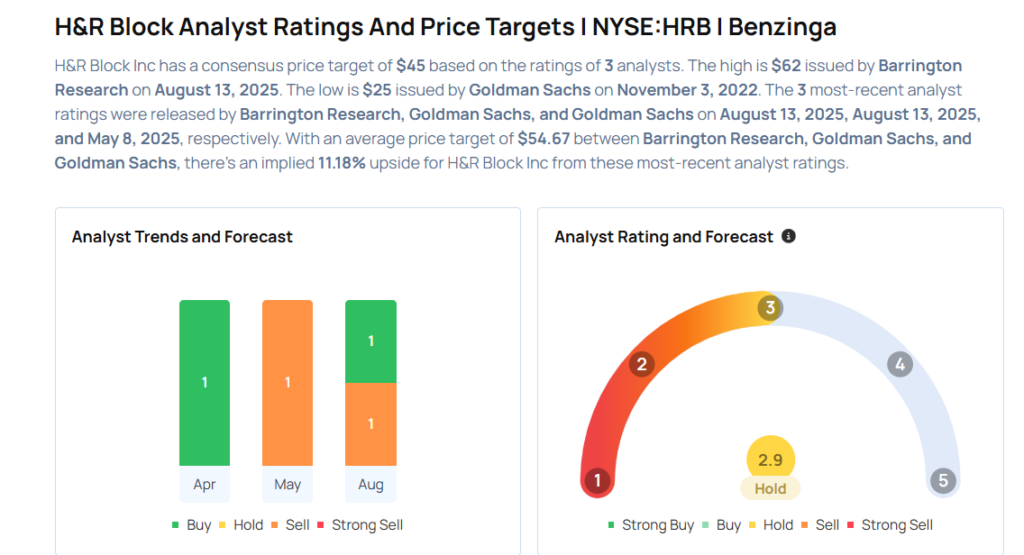

These analysts made changes to their price targets on H&R Block following earnings announcement.

- Goldman Sachs analyst George Kelly maintained H&R Block with a Sell and lowered the price target from $54 to $48.

- Barrington Research analyst Alexander Paris maintained the stock with an Outperform rating and lowered the price target from $70 to $62.

Considering buying HRB stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock