Genesco Inc. (NYSE:GCO) posted better-than-expected second-quarter results but issued FY26 sales guidance below estimates.

Genesco reported quarterly losses of $1.14 per share which beat the analyst consensus estimate of losses of $1.25 per share. The company reported quarterly sales of $545.965 million which beat the analyst consensus estimate of $532.386 million.

Genesco raised its FY2026 sales guidance from $2.348 billion-$2.372 billion to $2.395 billion-$2.418 billion.

Mimi E. Vaughn, Genesco’s Board Chair, President and Chief Executive Officer, said, “We are pleased to report another quarter that exceeded expectations and our fourth consecutive quarter of positive comparable sales growth. The momentum from the second half of last year has continued in Fiscal 2026 highlighted by Journeys high-single digit comp increase as our strategic plan to accelerate growth continues to gain traction. Our focus on product elevation, enhanced customer experience, and strengthened brand positioning is resonating with our broader target teen customer base, as we outperform the market and drive increased share.”

Genesco shares fell 5.9% to close at $31.04 on Thursday.

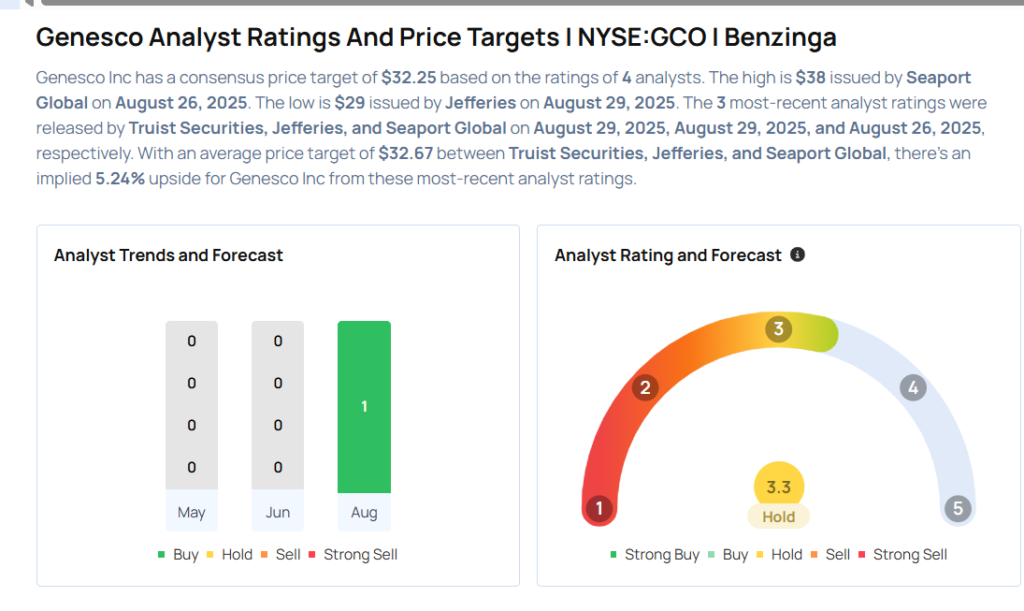

These analysts made changes to their price targets on Genesco following earnings announcement.

- Jefferies analyst Corey Tarlowe maintained Genesco with a Hold and raised the price target from $24 to $29.

- Truist Securities analyst Joseph Civello maintained Genesco with a Hold and raised the price target from $25 to $31.

Considering buying GCO stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock