4 analysts have shared their evaluations of Grand Canyon Education (NASDAQ:LOPE) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 4 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 2 | 0 | 0 | 0 |

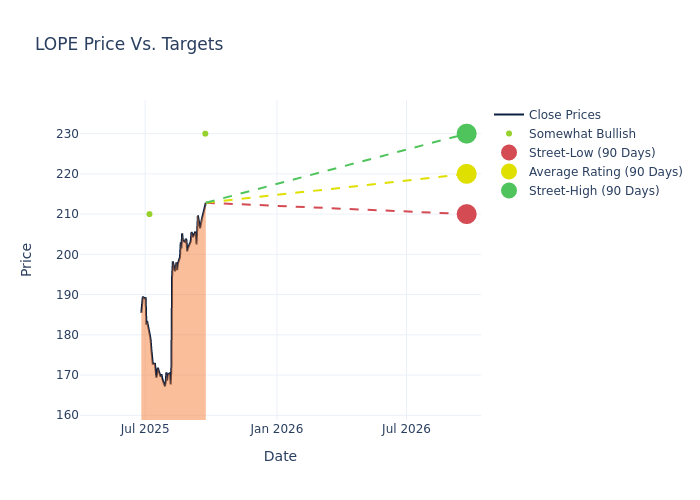

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $217.5, a high estimate of $230.00, and a low estimate of $210.00. A 1.36% drop is evident in the current average compared to the previous average price target of $220.50.

Investigating Analyst Ratings: An Elaborate Study

The standing of Grand Canyon Education among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Alexander Paris | Barrington Research | Maintains | Outperform | $230.00 | $230.00 |

| Alexander Paris | Barrington Research | Maintains | Outperform | $215.00 | $215.00 |

| Alexander Paris | Barrington Research | Maintains | Outperform | $215.00 | $215.00 |

| Jeffrey Silber | BMO Capital | Lowers | Outperform | $210.00 | $222.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Grand Canyon Education. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Grand Canyon Education compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Grand Canyon Education's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Grand Canyon Education analyst ratings.

Delving into Grand Canyon Education's Background

Grand Canyon Education Inc is a publicly traded education services company dedicated to serving colleges and universities. GCE's university partner is Grand Canyon University, an Arizona non-profit corporation that operates a comprehensive regionally accredited university that offers graduate and undergraduate degree programs, emphases, and certificates across nine colleges both online, on the ground at its campus in Phoenix, Arizona and at four off-site classroom and laboratory sites. The Company generates all of its revenue through services agreements with its university partners.

Grand Canyon Education's Economic Impact: An Analysis

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Grand Canyon Education's remarkable performance in 3M is evident. As of 30 June, 2025, the company achieved an impressive revenue growth rate of 8.81%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Net Margin: Grand Canyon Education's net margin is impressive, surpassing industry averages. With a net margin of 16.79%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Grand Canyon Education's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 5.33%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Grand Canyon Education's ROA excels beyond industry benchmarks, reaching 4.05%. This signifies efficient management of assets and strong financial health.

Debt Management: Grand Canyon Education's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.14.

The Significance of Analyst Ratings Explained

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.