Cintas Corporation (NASDAQ: CTAS) posted stronger-than-expected first-quarter sales and expanding margins on Wednesday.

The firm reported first-quarter earnings per share of $1.20, in line with the analyst consensus estimate. Quarterly sales of $2.718 billion (+8.7% year over year), beating the Street view of $2.698 billion. Revenue growth in the quarter was positively impacted by 0.9% due to acquisitions.

"Our ability to generate robust cash flow has enabled us to pursue balanced capital allocation – investing in our future while returning capital to shareholders," said CEO Todd M. Schneider.

The firm raised its fiscal 2026 GAAP EPS guidance to $4.74–$4.86 from $4.71–$4.85, versus the $4.86 consensus. It also lifted its fiscal 2026 sales outlook to $11.06 billion—$11.18 billion from $11.00 billion—$11.15 billion, compared with the $11.113 billion estimate.

Cintas shares gained 1.7% to $203.34 on Thursday.

These analysts made changes to their price targets on Cintas following earnings announcement.

- JP Morgan analyst Andrew Steinerman maintained Cintas with an Overweight rating and lowered the price target from $246 to $230.

- Wells Fargo analyst Jason Haas maintained the stock with an Equal-Weight rating and cut the price target from $221 to $218.

- RBC Capital analyst Ashish Sabadra maintained Cintas with a Sector Perform and lowered the price target from $240 to $206.

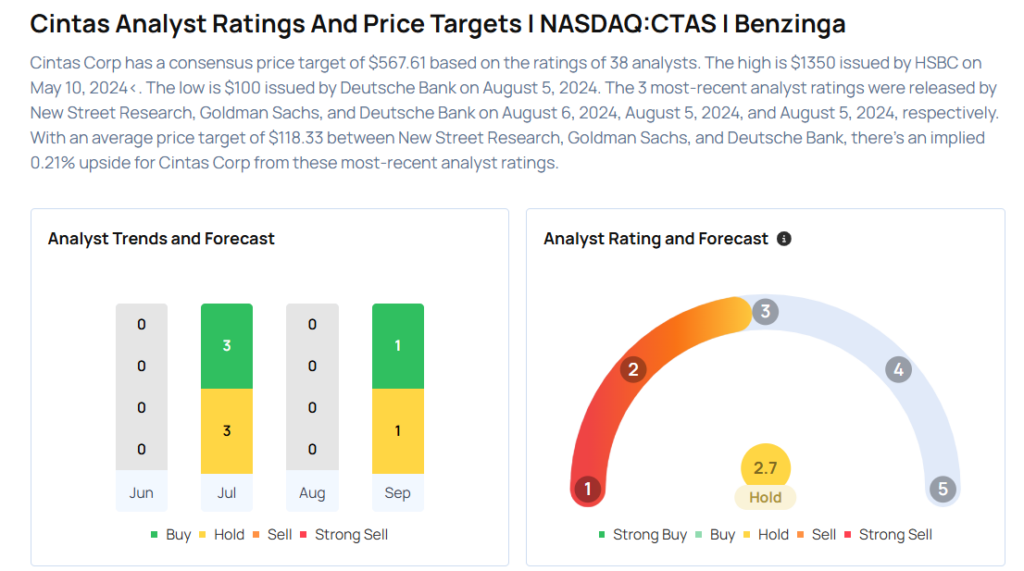

Considering buying CTAS stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock