Integral Ad Science Holdi (NASDAQ: IAS) has been analyzed by 5 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 3 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 1 | 1 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

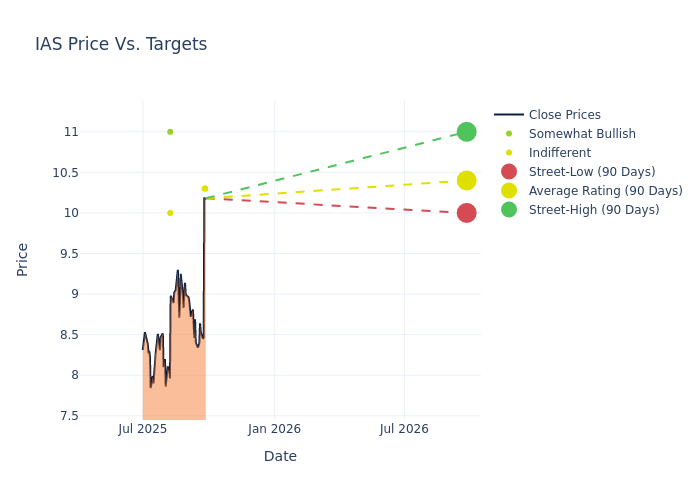

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $11.12, a high estimate of $14.00, and a low estimate of $10.00. Observing a downward trend, the current average is 4.14% lower than the prior average price target of $11.60.

Understanding Analyst Ratings: A Comprehensive Breakdown

The perception of Integral Ad Science Holdi by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Mark Kelley | Stifel | Lowers | Hold | $10.30 | $14.00 |

| Vikram Kesavabhotla | Baird | Raises | Neutral | $10.30 | $9.00 |

| Andrew Marok | Raymond James | Lowers | Outperform | $11.00 | $13.00 |

| Raimo Lenschow | Barclays | Raises | Equal-Weight | $10.00 | $9.00 |

| Mark Kelley | Stifel | Raises | Buy | $14.00 | $13.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Integral Ad Science Holdi. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Integral Ad Science Holdi compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Integral Ad Science Holdi's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Integral Ad Science Holdi's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Integral Ad Science Holdi analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Get to Know Integral Ad Science Holdi Better

Integral Ad Science Holding Corp is a digital advertising verification company. The cloud-based technology platform of the company delivers independent measurement and verification of digital advertising across all devices, channels, and formats, including desktop, mobile, connected TV, social, display, and video. Geographically, the company derives a majority of its revenue from the Americas region.

Understanding the Numbers: Integral Ad Science Holdi's Finances

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Over the 3M period, Integral Ad Science Holdi showcased positive performance, achieving a revenue growth rate of 15.66% as of 30 June, 2025. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Communication Services sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Integral Ad Science Holdi's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 11.0% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 1.56%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Integral Ad Science Holdi's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.42% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: With a below-average debt-to-equity ratio of 0.03, Integral Ad Science Holdi adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Significance of Analyst Ratings Explained

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.