Ratings for Charles River (NYSE:CRL) were provided by 7 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 3 | 2 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 2 | 0 | 0 |

| 3M Ago | 1 | 1 | 0 | 0 | 0 |

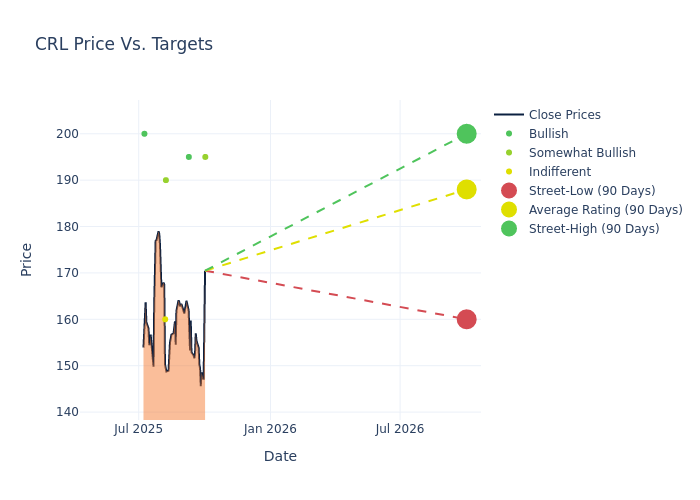

Insights from analysts' 12-month price targets are revealed, presenting an average target of $183.57, a high estimate of $200.00, and a low estimate of $160.00. Marking an increase of 16.08%, the current average surpasses the previous average price target of $158.14.

Diving into Analyst Ratings: An In-Depth Exploration

The standing of Charles River among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Luke Sergott | Barclays | Raises | Overweight | $195.00 | $165.00 |

| David Windley | Jefferies | Raises | Buy | $195.00 | $142.00 |

| Ross Muken | Evercore ISI Group | Raises | Outperform | $190.00 | $180.00 |

| Casey Woodring | JP Morgan | Raises | Neutral | $160.00 | $145.00 |

| Luke Sergott | Barclays | Raises | Equal-Weight | $165.00 | $155.00 |

| Ross Muken | Evercore ISI Group | Raises | Outperform | $180.00 | $170.00 |

| Patrick Donnelly | Citigroup | Raises | Buy | $200.00 | $150.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Charles River. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Charles River compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

To gain a panoramic view of Charles River's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Charles River analyst ratings.

Delving into Charles River's Background

Charles River Laboratories was founded in 1947 and is a leading provider of drug discovery and development services. The company's research model & services segment is the leading provider of animal models for laboratory testing, which breeds and delivers animal research models with specific genetic characteristics for preclinical studies around the world. The discovery & safety assessment segment includes services required to take a drug through the early development process, including discovery services. The manufacturing support segment includes microbial solutions, which provides in vitro (non-animal) testing products, biologics testing services, and avian vaccine services.

Charles River: A Financial Overview

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Positive Revenue Trend: Examining Charles River's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 0.59% as of 30 June, 2025, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Charles River's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 5.07% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Charles River's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 1.6%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Charles River's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.69%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Charles River's debt-to-equity ratio surpasses industry norms, standing at 0.83. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

How Are Analyst Ratings Determined?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.