9 analysts have expressed a variety of opinions on CF Industries Holdings (NYSE:CF) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 3 | 5 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 2 | 2 | 1 | 0 |

| 3M Ago | 0 | 1 | 2 | 0 | 0 |

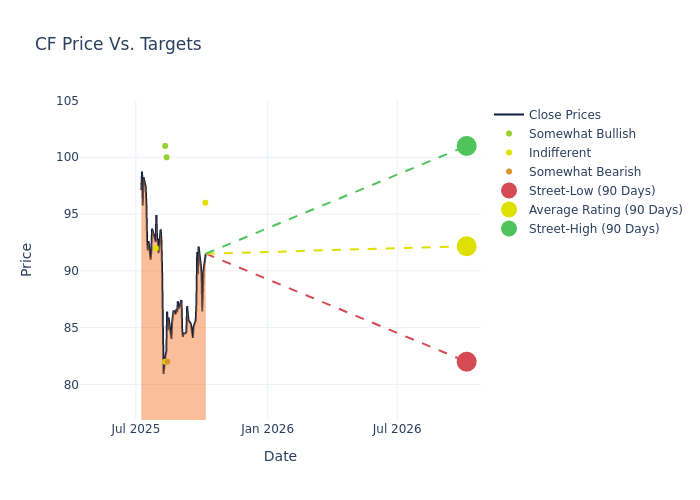

Insights from analysts' 12-month price targets are revealed, presenting an average target of $96.11, a high estimate of $108.00, and a low estimate of $82.00. This upward trend is apparent, with the current average reflecting a 2.6% increase from the previous average price target of $93.67.

Decoding Analyst Ratings: A Detailed Look

The standing of CF Industries Holdings among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Joshua Spector | UBS | Lowers | Neutral | $96.00 | $101.00 |

| Steve Byrne | B of A Securities | Lowers | Underperform | $82.00 | $93.00 |

| Benjamin Theurer | Barclays | Raises | Overweight | $100.00 | $95.00 |

| Ben Isaacson | Scotiabank | Raises | Sector Perform | $82.00 | $81.00 |

| Richard Garchitorena | Wells Fargo | Lowers | Overweight | $101.00 | $108.00 |

| Joshua Spector | UBS | Lowers | Neutral | $101.00 | $103.00 |

| Jeffrey Zekauskas | JP Morgan | Raises | Neutral | $92.00 | $75.00 |

| Joshua Spector | UBS | Raises | Neutral | $103.00 | $82.00 |

| Richard Garchitorena | Wells Fargo | Raises | Overweight | $108.00 | $105.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to CF Industries Holdings. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of CF Industries Holdings compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for CF Industries Holdings's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

For valuable insights into CF Industries Holdings's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on CF Industries Holdings analyst ratings.

All You Need to Know About CF Industries Holdings

CF Industries is a leading producer and distributor of nitrogen, which is primarily used in fertilizers. The company operates nitrogen manufacturing plants primarily in North America. CF also produces nitrogen in the United Kingdom and holds a joint venture interest in a nitrogen production facility in Trinidad and Tobago. CF makes nitrogen primarily using low-cost US natural gas as its feedstock, making the company one of the lowest-cost nitrogen producers globally. It is also investing in carbon-free blue and green ammonia, which can be used as an alternative fuel to hydrogen or as a means to transport hydrogen.

Financial Milestones: CF Industries Holdings's Journey

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Revenue Growth: CF Industries Holdings displayed positive results in 3M. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 20.23%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Materials sector.

Net Margin: CF Industries Holdings's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 20.42%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 7.92%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): CF Industries Holdings's ROA excels beyond industry benchmarks, reaching 2.85%. This signifies efficient management of assets and strong financial health.

Debt Management: With a high debt-to-equity ratio of 0.67, CF Industries Holdings faces challenges in effectively managing its debt levels, indicating potential financial strain.

Analyst Ratings: Simplified

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.