Synchrony Financial (NYSE:SYF) reported better-than-expected earnings for the third quarter on Wednesday.

The company posted third-quarter 2025 net earnings of $1.1 billion, or $2.86 per diluted share, compared with $789 million, or $1.94 per share, a year earlier.

The results topped expectations, with EPS beating the $2.20 estimate and revenue of $4.72 billion exceeding the $4.69 billion forecast. Net revenue rose 0.2% year over year to $3.82 billion, while net interest income increased 2.4% to $4.72 billion.

"Synchrony's third quarter performance was highlighted by a return to purchase volume growth, driven by stronger spend trends across all five of our platforms, and continued strength in our credit performance," said President and CEO Brian Doubles.

For fiscal 2025, Synchrony narrowed its sales outlook to $15.0 billion–$15.1 billion, down from $15.0 billion–$15.3 billion, which is below the $17.83 billion analyst estimate. The company expects flat loan receivables growth as higher payment rates offset purchase volume gains.

Synchrony shares fell 3.1% to $70.06 on Thursday.

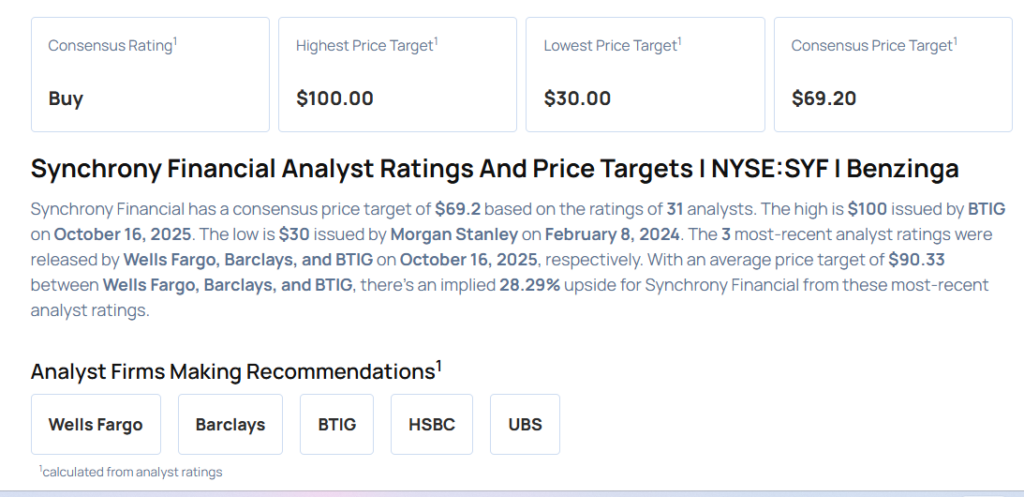

These analysts made changes to their price targets on Synchrony following earnings announcement.

- Barclays analyst Terry Ma maintained Synchrony Financial with an Overweight rating and raised the price target from $83 to $86.

- Wells Fargo analyst Donald Fandetti maintained the stock with an Overweight rating and raised the price target from $80 to $85.

- BTIG analyst Vincent Caintic reiterated Synchrony Financial with a Buy and maintained a $100 price target.

Considering buying SYF stock? Here’s what analysts think:

Photo via Shutterstock