Across the recent three months, 17 analysts have shared their insights on Dick's Sporting Goods (NYSE:DKS), expressing a variety of opinions spanning from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 8 | 4 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 0 | 0 | 0 |

| 2M Ago | 3 | 7 | 2 | 0 | 0 |

| 3M Ago | 0 | 0 | 2 | 0 | 0 |

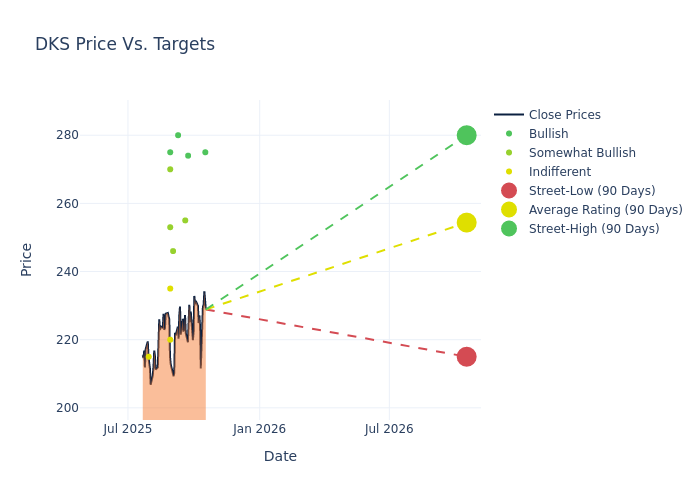

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $251.82, along with a high estimate of $280.00 and a low estimate of $215.00. This current average has increased by 9.52% from the previous average price target of $229.94.

Breaking Down Analyst Ratings: A Detailed Examination

A comprehensive examination of how financial experts perceive Dick's Sporting Goods is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Joseph Civello | Truist Securities | Raises | Buy | $275.00 | $248.00 |

| Kate McShane | Goldman Sachs | Announces | Buy | $274.00 | - |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $255.00 | $255.00 |

| Paul Lejuez | Citigroup | Raises | Buy | $280.00 | $225.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $255.00 | $255.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $255.00 | $255.00 |

| Adrienne Yih | Barclays | Raises | Overweight | $246.00 | $232.00 |

| Christopher Horvers | JP Morgan | Raises | Neutral | $235.00 | $195.00 |

| Brian Nagel | Oppenheimer | Maintains | Outperform | $270.00 | $270.00 |

| Simeon Gutman | Morgan Stanley | Raises | Overweight | $253.00 | $232.00 |

| Michael Lasser | UBS | Raises | Buy | $275.00 | $225.00 |

| Ike Boruchow | Wells Fargo | Raises | Equal-Weight | $220.00 | $215.00 |

| Scot Ciccarelli | Truist Securities | Raises | Buy | $248.00 | $230.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $255.00 | $255.00 |

| Joseph Feldman | Telsey Advisory Group | Raises | Outperform | $255.00 | $220.00 |

| Ike Boruchow | Wells Fargo | Raises | Equal-Weight | $215.00 | $187.00 |

| Anthony Chukumba | Loop Capital | Raises | Hold | $215.00 | $180.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Dick's Sporting Goods. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Dick's Sporting Goods compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Dick's Sporting Goods's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Capture valuable insights into Dick's Sporting Goods's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Dick's Sporting Goods analyst ratings.

About Dick's Sporting Goods

Dick's Sporting Goods is a retailer that offers sports and outdoor apparel, footwear, and equipment online and in physical stores. The company's legacy business includes more than 700 stores under its own name, more than 100 Golf Galaxy golf specialty stores, and about 50 outlet stores. In September 2025, Dick's acquired multinational retailer Foot Locker. With this move, Dick's added more than 2,300 stores under the Foot Locker, Kids Foot Locker, Champs Sports, atmos, and WSS nameplates in North America, the Asia-Pacific, and EMEA—Europe, the Middle East, and Africa. Based in the Pittsburgh area, Dick's was founded in 1948 by the father of current executive chair and controlling shareholder Edward Stack.

Financial Milestones: Dick's Sporting Goods's Journey

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Dick's Sporting Goods's revenue growth over a period of 3M has been noteworthy. As of 31 July, 2025, the company achieved a revenue growth rate of approximately 4.98%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Net Margin: Dick's Sporting Goods's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 10.46%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Dick's Sporting Goods's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 11.9% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 3.61%, the company showcases effective utilization of assets.

Debt Management: With a high debt-to-equity ratio of 1.37, Dick's Sporting Goods faces challenges in effectively managing its debt levels, indicating potential financial strain.

The Significance of Analyst Ratings Explained

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.