Darling Ingredients (NYSE:DAR) is set to give its latest quarterly earnings report on Thursday, 2025-10-23. Here's what investors need to know before the announcement.

Analysts estimate that Darling Ingredients will report an earnings per share (EPS) of $0.20.

Investors in Darling Ingredients are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

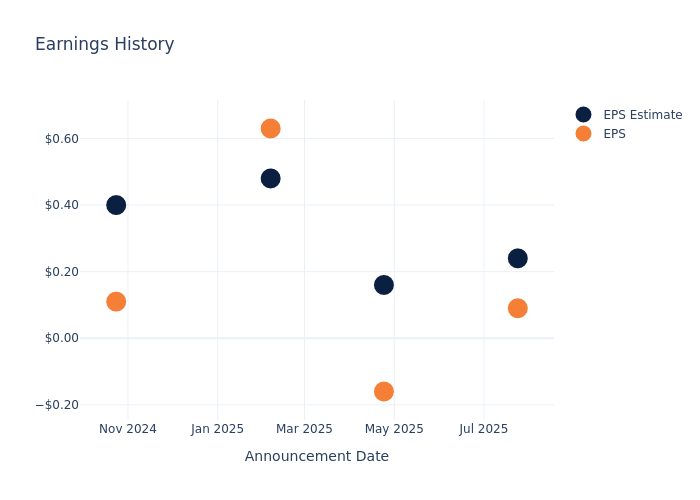

Past Earnings Performance

The company's EPS missed by $0.15 in the last quarter, leading to a 2.5% drop in the share price on the following day.

Here's a look at Darling Ingredients's past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.24 | 0.16 | 0.48 | 0.40 |

| EPS Actual | 0.09 | -0.16 | 0.63 | 0.11 |

| Price Change % | -3.00 | 5.00 | 3.00 | 4.00 |

Tracking Darling Ingredients's Stock Performance

Shares of Darling Ingredients were trading at $30.56 as of October 21. Over the last 52-week period, shares are down 18.25%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analysts' Perspectives on Darling Ingredients

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Darling Ingredients.

Analysts have provided Darling Ingredients with 5 ratings, resulting in a consensus rating of Buy. The average one-year price target stands at $43.6, suggesting a potential 42.67% upside.

Analyzing Ratings Among Peers

The below comparison of the analyst ratings and average 1-year price targets of and Ingredion, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Ingredion, with an average 1-year price target of $130.0, suggesting a potential 325.39% upside.

Summary of Peers Analysis

The peer analysis summary offers a detailed examination of key metrics for and Ingredion, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Darling Ingredients | Buy | 1.80% | $345.92M | 0.28% |

| Ingredion | Neutral | -2.40% | $477M | 4.74% |

Key Takeaway:

Darling Ingredients ranks higher in Revenue Growth compared to its peer. However, it lags behind in Gross Profit and Return on Equity.

About Darling Ingredients

Darling Ingredients Inc develops and manufactures sustainable ingredients for customers in the pharmaceutical, food, pet food, fuel, and fertilizer industries. It collects and transforms all aspects of animal by-product streams into ingredients, including gelatin, fats, proteins, pet food ingredients, fertilizers. Also, the company recovers and converts used cooking oil and bakery remnants into feed and fuel ingredients. Darling has three primary business segments which are feed ingredients contributing the majority of revenue, food ingredients, and fuel ingredients. It provides grease trap services for food businesses and sells various equipment for collecting and delivering cooking oil. The company derives the majority of its revenue from customers in North America.

Breaking Down Darling Ingredients's Financial Performance

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Darling Ingredients's revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2025, the company achieved a revenue growth rate of approximately 1.8%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Staples sector.

Net Margin: Darling Ingredients's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 0.85% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 0.28%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Darling Ingredients's ROA stands out, surpassing industry averages. With an impressive ROA of 0.12%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Darling Ingredients's debt-to-equity ratio surpasses industry norms, standing at 0.91. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

To track all earnings releases for Darling Ingredients visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.