Chemed (NYSE:CHE) is gearing up to announce its quarterly earnings on Tuesday, 2025-10-28. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Chemed will report an earnings per share (EPS) of $5.19.

The market awaits Chemed's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

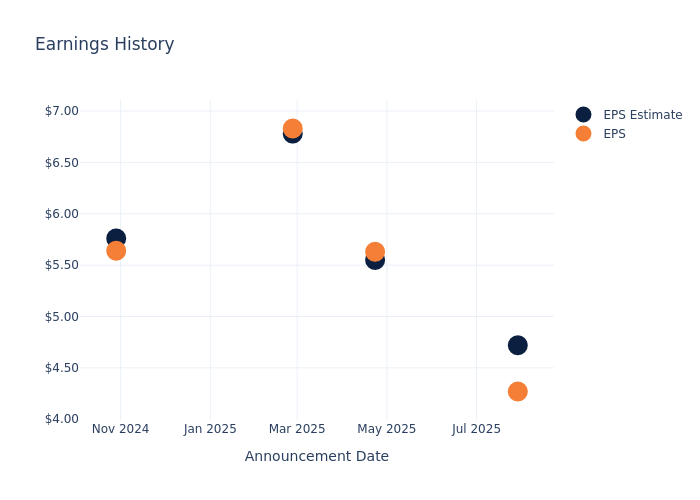

Earnings Track Record

The company's EPS missed by $0.45 in the last quarter, leading to a 10.36% drop in the share price on the following day.

Here's a look at Chemed's past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 4.72 | 5.55 | 6.78 | 5.76 |

| EPS Actual | 4.27 | 5.63 | 6.83 | 5.64 |

| Price Change % | -10.00 | -7.00 | 7.00 | -12.00 |

Tracking Chemed's Stock Performance

Shares of Chemed were trading at $436.62 as of October 24. Over the last 52-week period, shares are down 28.66%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

Insights Shared by Analysts on Chemed

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Chemed.

The consensus rating for Chemed is Buy, derived from 4 analyst ratings. An average one-year price target of $578.5 implies a potential 32.5% upside.

Comparing Ratings with Peers

This comparison focuses on the analyst ratings and average 1-year price targets of RadNet, BrightSpring Health and Option Care Health, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for RadNet, with an average 1-year price target of $78.33, suggesting a potential 82.06% downside.

- Analysts currently favor an Outperform trajectory for BrightSpring Health, with an average 1-year price target of $32.6, suggesting a potential 92.53% downside.

- Analysts currently favor an Outperform trajectory for Option Care Health, with an average 1-year price target of $35.25, suggesting a potential 91.93% downside.

Snapshot: Peer Analysis

The peer analysis summary offers a detailed examination of key metrics for RadNet, BrightSpring Health and Option Care Health, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Chemed | Buy | 3.85% | $184.69M | 4.41% |

| RadNet | Buy | 8.38% | $69.14M | 1.58% |

| BrightSpring Health | Outperform | 5.92% | $374.85M | 3.14% |

| Option Care Health | Outperform | 15.39% | $269.04M | 3.73% |

Key Takeaway:

Chemed ranks at the top for Gross Profit and Return on Equity among its peers. It is in the middle for Revenue Growth.

Unveiling the Story Behind Chemed

Chemed Corp purchases, operates, and divests subsidiaries engaged in diverse business activities to maximize shareholder value. Through its subsidiaries, the company operates in the following segments: VITAS and Roto-Rooter. The VITAS segment generates the majority of the firm's revenue and provides hospice and palliative care services to patients with terminal illnesses through a network of physicians, registered nurses, home health aides, social workers, and volunteers. The Roto-Rooter segment provides plumbing, drain cleaning, water restoration, and related services to residential and commercial customers.

Chemed: Delving into Financials

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining Chemed's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 3.85% as of 30 June, 2025, showcasing a substantial increase in top-line earnings. When compared to others in the Health Care sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Chemed's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 8.48% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 4.41%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 3.05%, the company showcases effective utilization of assets.

Debt Management: With a below-average debt-to-equity ratio of 0.12, Chemed adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Chemed visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.