Chegg Inc. (NYSE:CHGG) announced a massive restructuring plan on Oct. 27, 2025, that includes laying off 45% of its global workforce, or 388 employees. The company cited significant revenue declines from the “new realities of AI” as the primary driver for the move.

Check out CHGG stock price here.

Chegg Soars Over 4% After Announcing Restructuring Plan

Investors reacted positively to the drastic cost-cutting measures. After closing the regular session at $1.44 apiece, Chegg’s stock jumped $0.060, or 4.17%, in after-hours trading.

The sweeping changes also include a leadership shakeup. Executive Chairman Dan Rosensweig will reassume the roles of President and Chief Executive Officer, effective immediately. Nathan Schultz, the current President and CEO, will transition to an Executive Advisor role.

‘New Realities Of AI’ Fueled Shakeup At Chegg

In its official statement, Chegg directly blamed artificial intelligence and “reduced traffic from Google to content publishers” for a “significant decline in Chegg's traffic and revenue.” The restructuring is intended to deliver its academic learning services with a “substantially lower cost structure.”

This workforce reduction is expected to slash 2026 non-GAAP expenses by approximately $100-$110 million. The company anticipates incurring $15-$19 million in charges, mostly related to cash severance payments for the dismissed employees.

CHGG Eyes $40 Billion+ Skilling Market

Chegg stated that the new plan will generate increased cash flow to invest in what it calls its highest growth opportunity: the $40 billion+ skilling market.

The company is pivoting to focus on its business-to-business (B2B) organizations, including its professional language learning platform Busuu and its AI-related skills courses. These businesses are projected to generate approximately $70 million in revenue in 2025.

Chegg reiterated its revenue and adjusted EBITDA guidance for the third quarter of 2025. The company confirmed that additional details about the restructuring will be shared during its third-quarter 2025 earnings call on Nov. 10, 2025.

Chegg Underperforms The Market In 2025

Shares of Chegg were down 14.29% on a year-to-date basis as compared to 17.15% gains in the S&P 500 index. The stock also declined by 15.79% over the year.

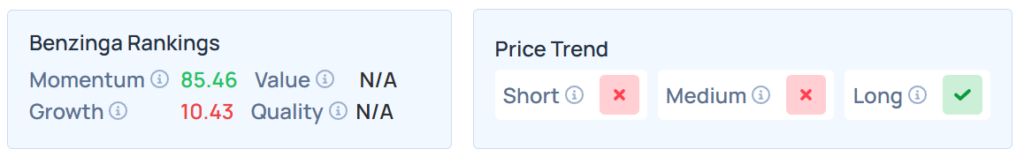

It maintained a weaker price trend over short and medium terms but a strong trend in the long term, with a poor growth ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

On Tuesday, the futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were trading lower.

Meanwhile, on Monday, the S&P 500 index ended 1.23% higher at 6,875.16, whereas the Nasdaq 100 index rose 1.83% to 25,821.54. On the other hand, Dow Jones advanced 0.71% to end at 47,544.59.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: rafapress / Shutterstock.com