Shares of Beyond Meat Inc (NASDAQ:BYND) are trading lower Thursday morning, continuing a volatile week for the plant-based food producer. The current decline comes despite a lack of new company-specific catalysts for the session, suggesting investors are weighing recent fundamental disclosures.

- BYND stock is struggling to find support. See what is driving the move here.

What To Know: Earlier this week, Beyond Meat released preliminary third-quarter results that concerned investors, projecting stagnant revenue of approximately $70 million and weak gross margins. The company also signaled a significant non-cash impairment charge and costs from shutting down its China operations.

While the stock experienced a speculative rally mid-week fueled by extremely high short interest, that momentum appears to have faded. Investor focus is seemingly returning to the company's underlying financial health and ongoing restructuring challenges, which include a recently completed debt exchange offer. Analysts are forecasting a loss of 43 cents per share when the company officially reports earnings on Nov. 4.

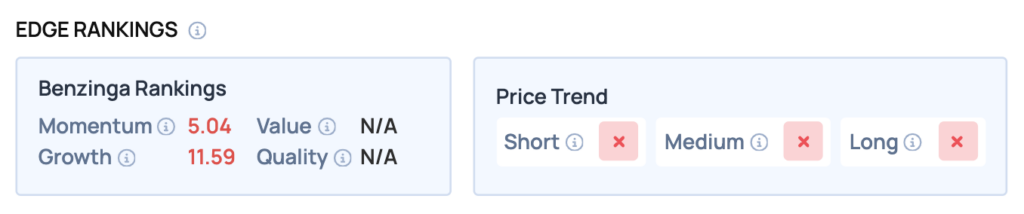

Benzinga Edge Rankings: According to Benzinga Edge Rankings, Beyond Meat is rated with a Growth score of 11.59.

BYND Price Action: Beyond Meat shares were down 10.37% at $1.65 at the time of publication on Thursday, according to Benzinga Pro data.

Read Also: Powell Taps The Brakes In The Fog, But Traders Keep Hitting The Gas

How To Buy BYND Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Beyond Meat’s case, it is in the Consumer Staples sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock