Verisk Analytics, Inc. (NASDAQ:VRSK) reported mixed third-quarter financial results and cut its FY25 sales guidance below estimates on Wednesday.

Verisk Analytics reported quarterly earnings of $1.72 per share which beat the analyst consensus estimate of $1.70 per share. The company reported quarterly sales of $768.300 million which missed the analyst consensus estimate of $776.094 million.

Verisk Analytics affirmed FY2025 adjusted EPS guidance of $6.80 to $7.00 and cut its sales guidance from $3.090 billion-$3.130 billion to $3.050 billion-$3.080 billion.

Lee Shavel, President and CEO, Verisk said, “I am pleased to share that Verisk is on track to deliver another year in line with our long-term growth targets. Our continued strategic engagement across the industry is opening new opportunities to partner with our clients and expanding our client base to new ecosystem participants. Through our C-suite engagements, we continue to hear support for us to provide more data and integrate that data more deeply into systems and the industry ecosystem generally for efficiency.”

Verisk Analytics shares rose 3.6% to trade at $215.54 on Thursday.

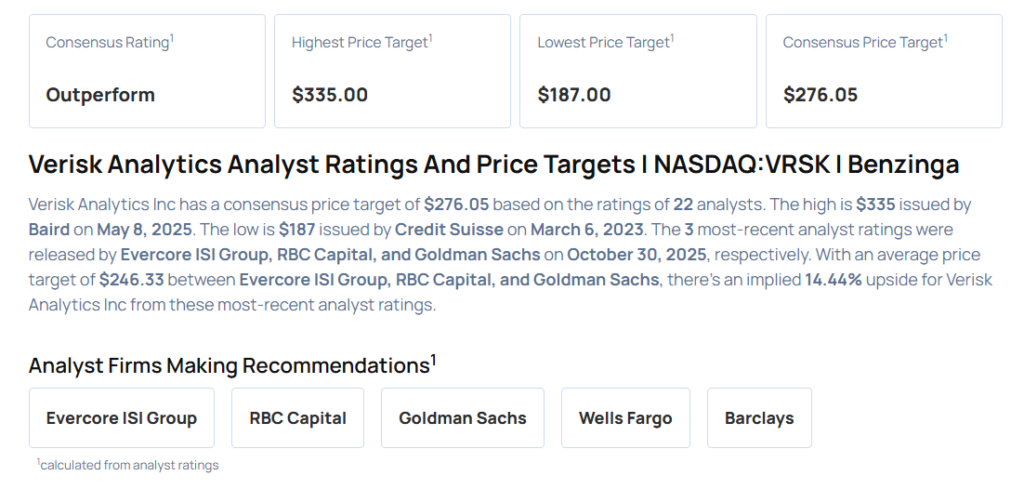

These analysts made changes to their price targets on Verisk Analytics following earnings announcement.

- Barclays analyst Manav Patnaik upgraded Verisk Analytics from Equal-Weight to Overweight and lowered the price target from $310 to $275.

- Wells Fargo analyst Jason Haas maintained Verisk Analytics with an Overweight rating and cut the price target from $334 to $300.

- Goldman Sachs analyst Andre Benjamin maintained the stock with a Neutral and lowered the price target from $315 to $239.

- RBC Capital analyst Ashish Sabadra maintained the stock with an Outperform rating and lowered the price target from $314 to $250.

- Evercore ISI Group analyst David Motemaden maintained Verisk Analytics with an In-Line rating and lowered the price target from $262 to $250.

Considering buying VRSK stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock