Boise Cascade (NYSE:BCC) is gearing up to announce its quarterly earnings on Monday, 2025-11-03. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Boise Cascade will report an earnings per share (EPS) of $0.64.

Anticipation surrounds Boise Cascade's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

Historical Earnings Performance

During the last quarter, the company reported an EPS missed by $0.08, leading to a 4.91% increase in the share price on the subsequent day.

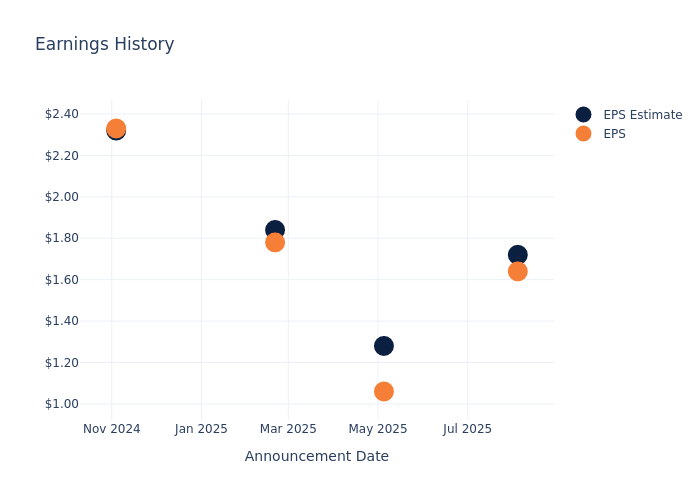

Here's a look at Boise Cascade's past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.72 | 1.28 | 1.84 | 2.32 |

| EPS Actual | 1.64 | 1.06 | 1.78 | 2.33 |

| Price Change % | 5.00 | -5.00 | -8.00 | 3.00 |

Boise Cascade Share Price Analysis

Shares of Boise Cascade were trading at $69.18 as of October 30. Over the last 52-week period, shares are down 47.27%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

Analyst Views on Boise Cascade

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Boise Cascade.

The consensus rating for Boise Cascade is Buy, derived from 5 analyst ratings. An average one-year price target of $96.4 implies a potential 39.35% upside.

Comparing Ratings Among Industry Peers

This comparison focuses on the analyst ratings and average 1-year price targets of McGrath RentCorp, Xometry and Custom Truck One Source, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for McGrath RentCorp, with an average 1-year price target of $143.0, suggesting a potential 106.71% upside.

- Analysts currently favor an Neutral trajectory for Xometry, with an average 1-year price target of $45.25, suggesting a potential 34.59% downside.

- Analysts currently favor an Underperform trajectory for Custom Truck One Source, with an average 1-year price target of $6.88, suggesting a potential 90.05% downside.

Comprehensive Peer Analysis Summary

The peer analysis summary presents essential metrics for McGrath RentCorp, Xometry and Custom Truck One Source, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Boise Cascade | Buy | -3.20% | $298.65M | 2.90% |

| McGrath RentCorp | Outperform | -3.87% | $119.26M | 3.59% |

| Xometry | Neutral | 22.59% | $65.18M | -9.11% |

| Custom Truck One Source | Underperform | 7.79% | $100.75M | -0.73% |

Key Takeaway:

Boise Cascade ranks at the top for Gross Profit and Return on Equity among its peers. It is in the middle for Revenue Growth.

Unveiling the Story Behind Boise Cascade

Boise Cascade Co is a producer of engineered wood products (EWP) and plywood. The firm operates in two reportable segments, namely Wood Products and Building Materials Distribution. The Wood Products segment manufactures laminated veneer lumber (LVL), I-joists, and laminated beams. In addition, it manufactures structural, appearance, and industrial-grade plywood panels, and ponderosa pine lumber. The Building Materials Distribution segment is engaged in the distribution of various building materials, including oriented strand board (OSB), plywood, and lumber; general line items such as siding, composite decking, doors and millwork, metal products, roofing, and insulation; and EWP, among others. The company generates a majority of its revenue from the Building Material Distribution segment.

Boise Cascade: A Financial Overview

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Negative Revenue Trend: Examining Boise Cascade's financials over 3 months reveals challenges. As of 30 June, 2025, the company experienced a decline of approximately -3.2% in revenue growth, reflecting a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Net Margin: Boise Cascade's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 3.56%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Boise Cascade's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 2.9%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Boise Cascade's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.79% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Boise Cascade's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.24.

To track all earnings releases for Boise Cascade visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.