Ryman Hospitality Props (NYSE:RHP) is set to give its latest quarterly earnings report on Monday, 2025-11-03. Here's what investors need to know before the announcement.

Analysts estimate that Ryman Hospitality Props will report an earnings per share (EPS) of $0.94.

Anticipation surrounds Ryman Hospitality Props's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

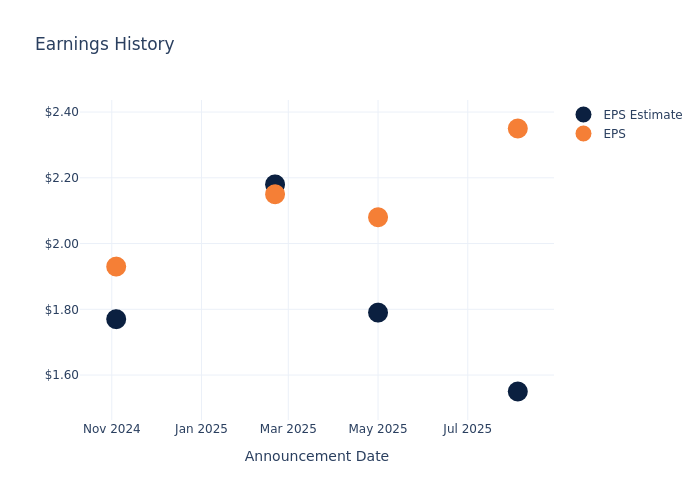

Earnings History Snapshot

Last quarter the company beat EPS by $0.80, which was followed by a 0.75% increase in the share price the next day.

Here's a look at Ryman Hospitality Props's past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.55 | 1.79 | 2.18 | 1.77 |

| EPS Actual | 2.35 | 2.08 | 2.15 | 1.93 |

| Price Change % | 1.00 | 6.00 | -5.00 | -1.00 |

Tracking Ryman Hospitality Props's Stock Performance

Shares of Ryman Hospitality Props were trading at $85.91 as of October 30. Over the last 52-week period, shares are down 21.06%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

Analyst Observations about Ryman Hospitality Props

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Ryman Hospitality Props.

With 4 analyst ratings, Ryman Hospitality Props has a consensus rating of Outperform. The average one-year price target is $106.0, indicating a potential 23.38% upside.

Comparing Ratings Among Industry Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Apple Hospitality REIT, Park Hotels & Resorts and Sunstone Hotel Invts, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for Apple Hospitality REIT, with an average 1-year price target of $13.33, suggesting a potential 84.48% downside.

- Analysts currently favor an Neutral trajectory for Park Hotels & Resorts, with an average 1-year price target of $11.75, suggesting a potential 86.32% downside.

- Analysts currently favor an Neutral trajectory for Sunstone Hotel Invts, with an average 1-year price target of $10.0, suggesting a potential 88.36% downside.

Peer Analysis Summary

The peer analysis summary offers a detailed examination of key metrics for Apple Hospitality REIT, Park Hotels & Resorts and Sunstone Hotel Invts, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Ryman Hospitality Props | Outperform | 7.54% | $217.25M | 10.77% |

| Apple Hospitality REIT | Outperform | -1.46% | $140.94M | 1.99% |

| Park Hotels & Resorts | Neutral | -2.04% | $212M | -0.14% |

| Sunstone Hotel Invts | Neutral | 4.97% | $130.55M | 0.39% |

Key Takeaway:

Ryman Hospitality Props ranks at the top for Revenue Growth and Gross Profit among its peers. It is in the middle for Return on Equity.

Get to Know Ryman Hospitality Props Better

Ryman Hospitality Properties Inc is a lodging and hospitality real estate investment trust that specializes in upscale convention center resorts and country music entertainment experiences. Its core holdings are Gaylord Opryland Resort & Convention Center; Gaylord Palms Resort & Convention Center; Gaylord Texan Resort & Convention Center; Gaylord National Resort & Convention Center; and Gaylord Rockies Resort & Convention Center. The company has three business segments: Hospitality, which includes Gaylord Hotels properties, the Inn at Opryland, and the AC Hotel, Entertainment which includes the entertainment and media assets comprising OEG, and Corporate and Other, which includes corporate expenses. It derives the vast majority of its revenue from its Hospitality segment.

Financial Insights: Ryman Hospitality Props

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Ryman Hospitality Props displayed positive results in 3 months. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 7.54%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Real Estate sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 10.88%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Ryman Hospitality Props's ROE stands out, surpassing industry averages. With an impressive ROE of 10.77%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Ryman Hospitality Props's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.26%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 5.15, caution is advised due to increased financial risk.

This article was generated by Benzinga's automated content engine and reviewed by an editor.